Navigating the complexities of financial consolidation can feel like traversing a minefield, especially when you’re dealing with multiple entities, each with its own unique accounting practices, currencies, and reporting requirements. I’ve been there, witnessed the spreadsheets stretching to infinity, and felt the collective sigh of relief when a robust Enterprise Resource Planning (ERP) system finally took over. Multi-entity consolidation within an ERP isn’t just about adding numbers; it’s about gaining a clear, unified view of your entire organization’s financial health, enabling informed decision-making and strategic growth.

This article dives deep into the world of multi-entity consolidation within enterprise ERP systems. We’ll explore what it is, why it’s crucial for modern businesses, and the key features and considerations when selecting and implementing an ERP solution capable of handling this complex task. Think of this as your comprehensive guide, designed to demystify the process and empower you to make the right choices for your organization. We’ll also address some common pain points and offer practical insights based on real-world experiences.

From defining the core concepts to exploring advanced features and best practices, we aim to provide a holistic understanding of multi-entity consolidation within the ERP landscape. Whether you’re a seasoned CFO, a finance manager, or simply someone looking to understand the power of ERP, this guide will equip you with the knowledge you need to navigate the complexities of financial consolidation and unlock the true potential of your data. So, let’s embark on this journey together and unravel the intricacies of multi-entity consolidation in enterprise ERP.

What is Multi-Entity Consolidation in ERP?

Multi-entity consolidation within an ERP system refers to the process of combining the financial results of multiple legal entities (subsidiaries, divisions, branches, etc.) into a single, consolidated financial statement. This consolidated view provides a comprehensive overview of the entire organization’s financial performance and position, as if it were a single entity. It’s more than just adding up numbers; it’s about eliminating intercompany transactions, harmonizing accounting practices, and ensuring accurate and compliant reporting.

Key Concepts in Multi-Entity Consolidation

Understanding these concepts is crucial for navigating the consolidation process:

- Intercompany Transactions: These are transactions that occur between entities within the same organization (e.g., sales, loans, services). These must be identified and eliminated during consolidation to avoid double-counting revenue and expenses.

- Elimination Entries: These are journal entries made during the consolidation process to remove the impact of intercompany transactions. This ensures the consolidated financials accurately reflect the group’s performance with external parties.

- Currency Conversion: When entities operate in different currencies, their financial data must be converted to a common currency for consolidation. This involves choosing appropriate exchange rates and accounting for translation gains or losses.

- Minority Interest: If the parent company owns less than 100% of a subsidiary, the portion of the subsidiary’s net income and equity not owned by the parent is referred to as minority interest (also known as non-controlling interest) and must be accounted for separately in the consolidated financial statements.

- Chart of Accounts Harmonization: Ensuring that all entities use a consistent chart of accounts is vital for accurate consolidation. This involves mapping accounts across different entities to ensure that similar transactions are recorded in the same way.

Why is Multi-Entity Consolidation Important?

The importance of multi-entity consolidation extends far beyond simply meeting regulatory requirements. It provides significant benefits that can drive strategic decision-making and improve overall business performance.

Benefits of Multi-Entity Consolidation

- Accurate Financial Reporting: Provides a true and fair view of the organization’s financial performance and position, compliant with accounting standards like GAAP or IFRS.

- Improved Decision-Making: Enables informed decisions based on a complete and accurate picture of the entire organization, rather than fragmented views of individual entities.

- Enhanced Visibility: Offers a clear understanding of intercompany relationships, profitability across different entities, and overall financial risks and opportunities.

- Streamlined Processes: Automates the consolidation process, reducing manual effort, errors, and time spent on financial reporting.

- Reduced Audit Costs: Simplifies the audit process by providing a single, consolidated view of the organization’s financials.

- Better Compliance: Ensures compliance with regulatory requirements for consolidated financial reporting.

Consequences of Inaccurate Consolidation

Failing to accurately consolidate financial data can have serious consequences:. Many businesses are seeking to streamline their operations, and Advanced Erp Solutions can offer a comprehensive approach to achieving that goal

- Misleading Financial Statements: Can lead to poor investment decisions, inaccurate tax filings, and potential legal issues.

- Inefficient Resource Allocation: Hinders the ability to identify profitable areas of the business and allocate resources effectively.

- Increased Audit Risk: Increases the likelihood of audit findings and potential penalties.

- Damaged Reputation: Can erode investor confidence and damage the organization’s reputation.

Key Features of an ERP System for Multi-Entity Consolidation

Not all ERP systems are created equal when it comes to multi-entity consolidation. Look for these key features to ensure the system can meet your organization’s needs:

Essential Features

- Chart of Accounts Management: Ability to define and manage a standardized chart of accounts across all entities, with flexible mapping capabilities for entities with different charts.

- Intercompany Transaction Management: Automated identification and elimination of intercompany transactions, with built-in reconciliation tools.

- Currency Conversion: Support for multiple currencies, with automated currency conversion based on configurable exchange rates.

- Consolidation Rules Engine: Flexible rules engine to define consolidation hierarchies, ownership percentages, and elimination methods.

- Reporting and Analytics: Robust reporting and analytics capabilities to generate consolidated financial statements, analyze performance across entities, and identify key trends.

- Audit Trail: Comprehensive audit trail to track all changes made during the consolidation process, ensuring transparency and accountability.

- Security and Access Control: Role-based security and access control to restrict access to sensitive financial data.

Advanced Features

Beyond the essentials, consider these advanced features for more complex consolidation scenarios:

- Automated Reconciliation: Automated reconciliation of intercompany balances, reducing manual effort and improving accuracy.

- Tax Provisioning: Integration with tax provisioning software to automate the calculation of consolidated tax liabilities.

- Budgeting and Forecasting: Ability to create consolidated budgets and forecasts based on individual entity data.

- What-If Analysis: Scenario planning tools to assess the impact of different business decisions on consolidated financial results.

- Integration with Other Systems: Seamless integration with other enterprise systems, such as CRM and supply chain management, to provide a holistic view of the business.

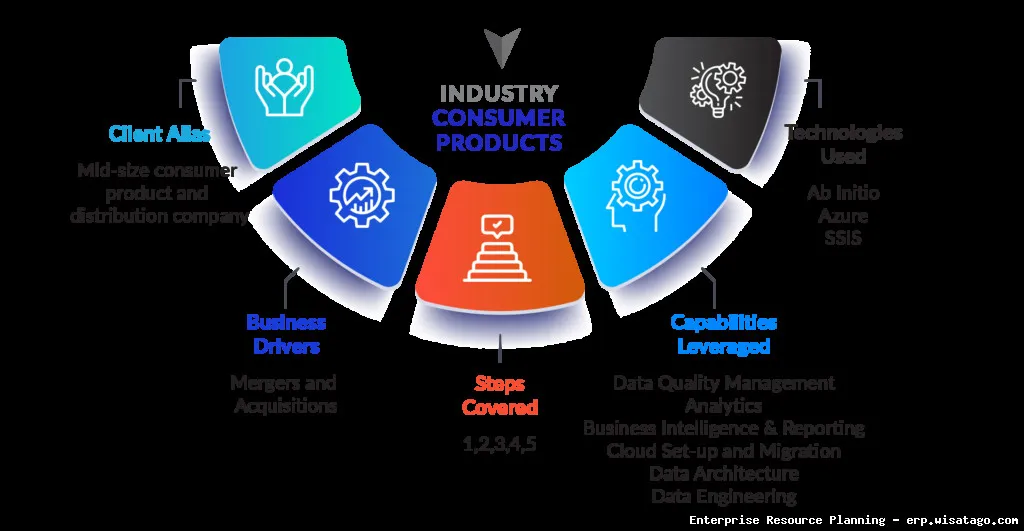

Choosing the Right ERP System for Multi-Entity Consolidation

Selecting the right ERP system for multi-entity consolidation is a critical decision that can significantly impact your organization’s financial reporting and overall business performance. Here’s a step-by-step guide to help you make the right choice:

Step 1: Define Your Requirements

Start by clearly defining your organization’s specific requirements for multi-entity consolidation. Consider factors such as:

- Number of Entities: How many entities need to be consolidated?

- Complexity of Intercompany Transactions: How complex are your intercompany transactions?

- Currency Requirements: How many currencies do you need to support?

- Reporting Requirements: What types of consolidated financial statements do you need to generate?

- Regulatory Requirements: What regulatory requirements do you need to comply with?

- Future Growth: Consider your future growth plans and choose a system that can scale with your organization.

Step 2: Evaluate Potential ERP Systems

Once you have a clear understanding of your requirements, evaluate potential ERP systems based on the key features and advanced features discussed earlier. Consider factors such as:

- Functionality: Does the system offer the functionality you need for multi-entity consolidation?

- Scalability: Can the system scale to meet your future needs?

- Usability: Is the system easy to use and navigate?

- Integration: Does the system integrate with your other enterprise systems?

- Vendor Reputation: Does the vendor have a good reputation for providing reliable software and support?

- Cost: What is the total cost of ownership, including software licenses, implementation services, and ongoing maintenance?

Step 3: Request Demos and Proof of Concepts

Request demos and proof of concepts from potential ERP vendors to see how the system works in practice. This will allow you to:

- Evaluate the system’s functionality: See how the system handles your specific consolidation scenarios.

- Assess the system’s usability: Determine if the system is easy to use and navigate.

- Evaluate the vendor’s support: Assess the vendor’s responsiveness and expertise.

Step 4: Check References

Check references from other organizations that have implemented the ERP system. This will provide valuable insights into the system’s performance and the vendor’s support.

Step 5: Make a Decision

Based on your evaluation, choose the ERP system that best meets your organization’s needs and budget.

Common Challenges and Best Practices

Implementing multi-entity consolidation within an ERP system can be challenging, but by understanding the common pitfalls and adopting best practices, you can increase your chances of success.

Common Challenges

- Data Quality: Inconsistent or inaccurate data can lead to errors in the consolidation process.

- Chart of Accounts Harmonization: Mapping accounts across different entities can be complex and time-consuming.

- Intercompany Transaction Reconciliation: Reconciling intercompany balances can be challenging, especially when dealing with a large volume of transactions.

- Change Management: Implementing a new ERP system can be disruptive to existing processes and require significant change management efforts.

- User Training: Proper user training is essential to ensure that users understand how to use the system effectively.

Best Practices

- Establish a Clear Consolidation Policy: Define a clear consolidation policy that outlines the rules and procedures for consolidating financial data.

- Standardize the Chart of Accounts: Implement a standardized chart of accounts across all entities.

- Automate Intercompany Transaction Reconciliation: Use automated tools to reconcile intercompany balances.

- Invest in Data Quality: Implement data quality controls to ensure that data is accurate and consistent.

- Provide Comprehensive User Training: Provide comprehensive user training to ensure that users understand how to use the system effectively.

- Engage Stakeholders: Engage stakeholders from all entities in the implementation process.

- Monitor and Review: Continuously monitor and review the consolidation process to identify areas for improvement.

Conclusion

Multi-entity consolidation within an enterprise ERP system is a complex but essential process for organizations with multiple legal entities. By understanding the key concepts, features, and challenges, and by adopting best practices, you can streamline the consolidation process, improve financial reporting, and gain valuable insights into your organization’s financial performance. Choosing the right ERP system is a critical step in this process, so be sure to carefully evaluate your options and select a system that meets your specific needs. The investment in a robust ERP solution with strong multi-entity consolidation capabilities will pay dividends in the form of accurate reporting, informed decision-making, and improved overall business performance.

Conclusion

In conclusion, multi-entity consolidation within an Enterprise ERP system is no longer a ‘nice-to-have’ but a strategic imperative for organizations operating across multiple subsidiaries, divisions, or geographical locations. As we’ve explored, implementing a robust consolidation solution streamlines financial reporting, enhances data accuracy, and provides a unified view of the entire enterprise’s performance. This heightened visibility empowers leadership to make more informed decisions, optimize resource allocation, and ultimately drive greater profitability and shareholder value. Ignoring the benefits of a centralized consolidation process can leave organizations vulnerable to inefficiencies, errors, and a lack of strategic agility in today’s dynamic business environment.

By centralizing financial data and automating the consolidation process, companies can significantly reduce the time and effort required for financial close, while also improving the reliability and transparency of their financial statements. If your organization is currently grappling with disparate systems, manual processes, or a lack of comprehensive financial insight, now is the time to assess your current ERP capabilities and explore the potential of multi-entity consolidation. Investing in the right technology and expertise will pave the way for greater efficiency, improved compliance, and a more data-driven approach to business management. We encourage you to contact our team to discuss how a tailored multi-entity consolidation solution can unlock the full potential of your enterprise.

Frequently Asked Questions (FAQ) about Multi-Entity Consolidation in Enterprise ERP

What are the key benefits of implementing multi-entity consolidation within an Enterprise Resource Planning (ERP) system, and how does it improve financial reporting accuracy?

Implementing multi-entity consolidation within an ERP system offers numerous benefits. Primarily, it streamlines the process of combining financial data from multiple subsidiaries or business units into a single, unified view. This enhanced visibility allows for a more accurate and comprehensive understanding of the organization’s overall financial performance. By automating the elimination of intercompany transactions and balances, the ERP system minimizes the risk of errors and inconsistencies that can arise from manual consolidation processes. This automation directly improves financial reporting accuracy, leading to more reliable financial statements for internal decision-making, external audits, and regulatory compliance. It also allows for better analysis of profitability across different entities and supports strategic planning by providing a clearer picture of the group’s financial health. Many organizations find that streamlining their operations is crucial for growth, ERP can be a valuable asset in achieving this goal

.

How does an ERP system handle currency translation and intercompany eliminations during multi-entity consolidation, and what are the common challenges encountered?

An ERP system with multi-entity consolidation capabilities typically handles currency translation by converting subsidiary financials into the parent company’s reporting currency using predefined exchange rates (e.g., average, spot, or historical rates). The system then automates the elimination of intercompany transactions, such as sales, purchases, loans, and dividends, to avoid double-counting revenues and expenses in the consolidated financial statements. This involves identifying and netting off reciprocal balances between entities. Common challenges include managing different accounting standards (e.g., GAAP vs. IFRS), maintaining accurate exchange rate data, properly identifying and classifying intercompany transactions, and ensuring the completeness and accuracy of subsidiary data. Dealing with complex ownership structures and varying levels of automation across entities can also pose significant hurdles. Proper system configuration and data governance are crucial for successful consolidation.

What features should I look for when selecting an Enterprise Resource Planning (ERP) system for multi-entity consolidation, particularly regarding automation and compliance capabilities?

When selecting an ERP system for multi-entity consolidation, several features are crucial. Look for robust automation capabilities, including automated intercompany eliminations, currency translation using various exchange rate options, and automated journal entries for consolidation adjustments. The system should support different accounting standards (e.g., GAAP, IFRS) and offer flexible reporting options to meet varying regulatory requirements. Strong audit trail functionality is essential for tracking changes and ensuring data integrity. Compliance capabilities should include features for generating consolidated financial statements in accordance with relevant accounting standards and facilitating audit processes. The system should also provide robust security measures to protect sensitive financial data across all entities. Furthermore, consider the system’s scalability to accommodate future growth and its integration capabilities with other business systems.